GST Login Procedure or Goods and Services Tax Login Process in www.gst.gov.in official website….

Good and Services Tax (GST) is the biggest Indirect tax reform in India that is levied on the supply of goods and services. Actually, GST is levied in every stage of production although it is usually refunded during the different stages of production. Ever since GST was introduced in India, it has been able to increase the taxation thanks to amalgamation of different State and Central taxes. GST has brought numerous benefits to trade and consumers. Below are some advantages that consumers enjoy with GST:

- Brings about uniform prices all over the country

- There is transparency when it comes to the taxation system

- Increase in employment opportunities

- Decrease in prices of goods and services.

Apart from Consumers, GST also brings about advantages in trade. These advantages include:

- Fewer rates and exemptions

- People no longer have to distinguish between goods and services

- Brings about a common national market

- Reduction in multiplicity of taxes

Accessing GST services is now very easy since the government is making use of GST portal to serve all citizens in India. With GST website, all you need is an internet connection in order to access all the services available. You will also need a device that can access the internet i.e. Smartphone or Personal Computer. This action can be performed regardless of your current location.

Other services that you can get from the GST portal include:

- Filing GST returns

- Viewing e-Ledgers

- Opting out of Composition Scheme

- Filing table 6A of GSTR-1

- Opting for composition scheme

GST login in https://www.gst.gov.in/ Website

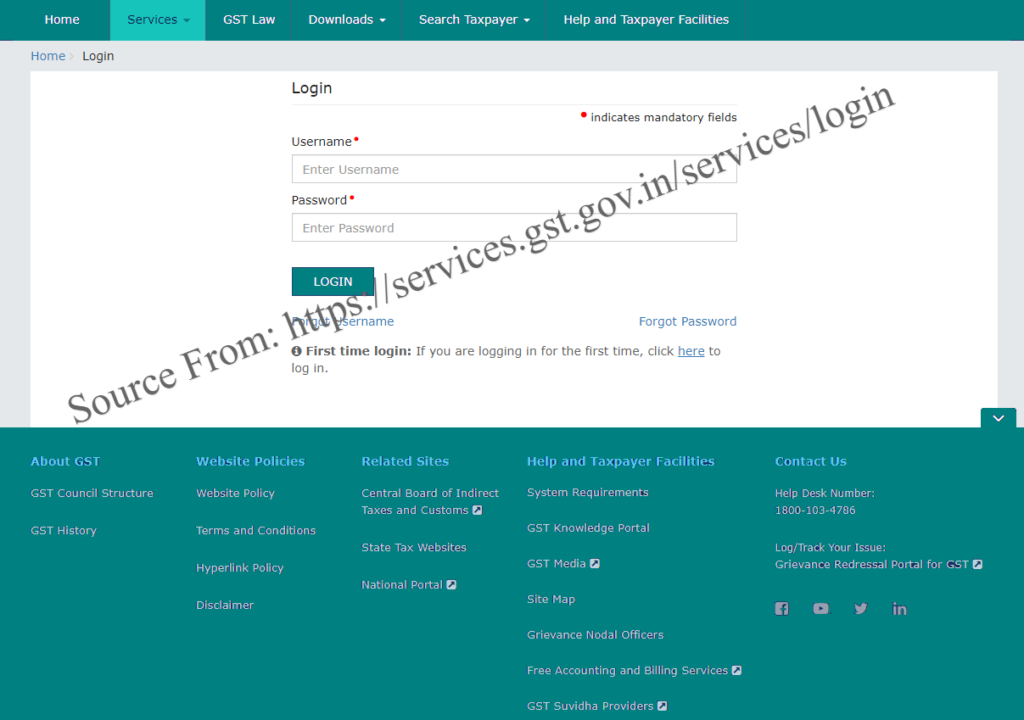

Any taxpayer who wants to log into GST Portal will have to follow the simple guide given below.

- Enter https://www.gst.gov.in/on the search bar of your browser be it Google Chrome, Internet Explorer or Mozilla Firefox. Press the ‘Enter’ button on your keyboard to initiate the search.

- You will be redirected to the homepage of GST Website. Here, click on ‘Login’ button to generate the login page.

- Enter, your username in the space set aside for this option.

- Next, type in your password correctly

- Type the characters that appear in the captcha image.

- Finally, click on “Login” button to access your account. This action will open a new dashboard from where you can see a summary of your GST credits, Notice, GST Payable just to list but a few.

Note: Every client face an issue on ‘Failed To Establish Connection to the Server‘ while login time. Our team also give an information on it.

How to Fill GST Online Application in https://www.gst.gov.in/ Website

People who have goods that exceed a turnover of Rs. 20 Lakhs are required to register themselves on GST Portal. However, you must produce the relevant documents before registering on GST Login Portal. These documents include:

- Aadhaar card

- PAN card

- Digital Signature

- Letter of Authorization

- Proof of business registration

You will have to make use of the simple steps below to fill GST online application in https://www.gst.gov.in/ Website.

- Enter https://www.gst.gov.in/ on the search bar of your browser to access GST website.

- Place your mouse cursor on ‘Services’ option. This action will generate a drop down containing all the services in GST Website.

- Click on “Registration” tab to generate the online application form.

- You will then have to fill in the details correctly. These details include PAN Number, Mobile Number, Email ID, State just to name but a few.

- Enter the One Time Verification Pin (OTP) that will be sent to your Email Address after which you should click on “Proceed” button.

- After a successful verification, you will get a temporary reference number.

How to Login GST at www.gst.gov.in and What are the services provided in GST website?

How to GST Login at gst.gov.in?

First of all visit the https://www.gst.gov.in/ website. Now see the top side right corner of the page ‘Login’ option will be shown. Hit the ‘Login’ button. Then enter the user id and password. Click on Login.

How to Application for Registration?

Normal Taxpayers, ISD and Casual Dealers can now apply for GST registration online from the comfort of their houses. All you have to do is use the “Application for Registration” service to perform this action.

What are the Services provided in https://www.gst.gov.in/ Website

Goods and Services Tax website has quite a number of services that you can use. Taxpayers can make use of these services at any time of the day without having to worry about long queues. Unfortunately, you cannot use this web application when it is under maintenance. Below are some of the service that you can get when using GST Portal.

Application for Practitioner

This service is specifically set aside for any taxpayer who wants to apply for a practitioner. When using this service, you will have to fill in every detail correctly before completing the application process.

Payment of GST

Paying of GST fees is now easy since you can do it online as long as you have Net banking, Credit Card or Debit Card.

Claim Refund of Excess GST Paid

Initially, it would take some days before a taxpayer could get a refund whenever you get a refund on your excess GST payment. However, this is now a thing of the past since you can make the claim online in GST portal.